Valmet’s Remuneration Principles

Well-functioning and competitive remuneration is an essential tool for engaging competent members at the Board level, as executives and as experts at all levels of the organization. Remuneration must be in proportion to the long-term value creation and the achievement of the strategic objectives of the Company.

Remuneration at all levels of the organization is built on the following principles:

DRIVING HIGH PERFORMANCE

The objective of remuneration at Valmet is to encourage employees as individuals and as team members to achieve the set financial and operational targets and to strive for excellent performance. A key element of Valmet’s remuneration is the implementation of a pay-for-performance culture. All employees are eligible for a performance reward or bonus, linking rewarding to performance and strengthening individual and team accountability.

For key personnel and top management, including the President and CEO, a notable part of remuneration comes from variable pay, i.e., short-term and long-term incentives, to ensure that remuneration is aligned with the Company’s financial performance and linked to the successful implementation of the business strategy. Board member compensation is set at the Annual General Meeting

COMPETITIVE REMUNERATION TO RETAIN TALENT WITH THE BEST FIT

In determining appropriate remuneration levels, Valmet applies a benchmark approach, ensuring that remuneration is aligned with internal and external references and observing remuneration levels for similar positions among peer companies in the geographical area. Valmet’s approach is not to be the market leader in pay but to offer competitive remuneration to retain talent with the best fit. Valmet also utilizes a benchmark approach when determining remuneration levels for the President and CEO and the Board of Directors.

FAIRNESS AND SUSTAINABILITY

Valmet aims to ensure equal treatment and fair remuneration of employees at all levels of the organization by linking remuneration to role, the local salary market, and individual and/or team performance. Valmet’s remuneration approval principles are designed to ensure that changes in pay are always subject to grandparent approval. This supports the equality and impartiality of decisions related to pay at all levels of the organization.

Valmet’s variable pay schemes support sustainable business by linking selected sustainability topics such as health and safety and sustainable supply chain to remuneration. Sustainability is important to Valmet’s overall financial success, as well as share price development, and thus affects the total remuneration of Board members, as well as the President and CEO.

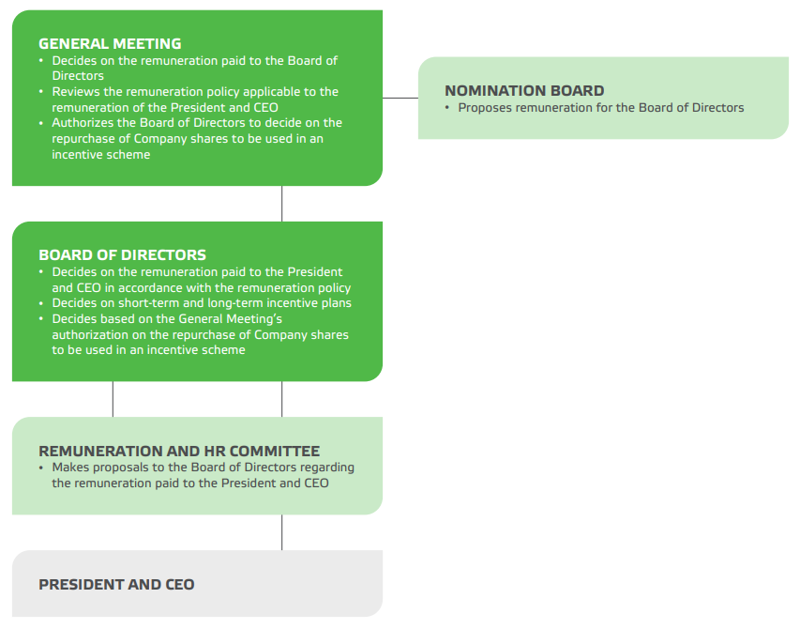

Decision-making process

All remuneration-related decisions require grandparent approval. In other words, the remuneration of an employee must always be approved by the manager’s manager. The decision-making process for the remuneration of the Board of Directors and the President and CEO is summarized in the chart below.