Sustainability for investors

We believe that sustainability creates long-term shareholder value and enables us better to embrace opportunities and manage risks deriving from economic, environmental and social megatrends.

Valmet's Climate program

Valmet has created an ambitious climate program − Forward to a carbon neutral future − which continues our comprehensive sustainability work. Carbon neutrality means a balance between emitted and absorbed carbon. Achieving zero carbon dioxide emissions is possible by eliminating or offsetting carbon dioxide emissions.

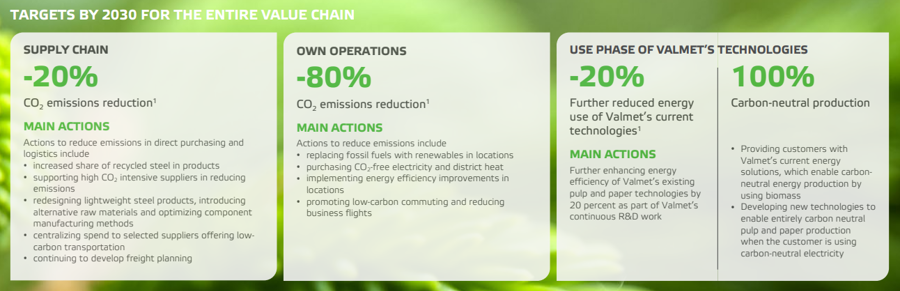

Our climate program includes ambitious CO₂ emission reduction targets and concrete actions for the whole value chain, including the supply chain, our own operations, and customers’ use of our technologies. These targets will be achieved without emission compensation. The program is aligned with the Paris Climate Agreement's 1.5-degree pathway and United Nations Sustainable Development Goals. The climate program's targets have been approved by the Science Based Targets initiative.

Read more about Valmet's Climate program.

Sustainability risks and opportunities

Valmet's business and competition environment is subject to a range of risks and opportunities, due to the company's broad scope of global operations and its technology and industry diversity. Valmet has a systematic method for regularly assessing the probability and impact of sustainability-related risks and opportunities. The topics include climate change, health and safety, environmental management, human rights and labor rights and ethical business practices both in own operations and supply chain. Management of sustainability risks and opportunities is integrated into the multi-disciplinary, group-wide risk management process at Valmet.

During recent years, we have seen growing interest from our customers in optimization regarding e.g. energy, chemicals savings, efficiency of operations and availability of equipment. As demand for more environmentally efficient processes and end-products increases, companies' ability to respond to these needs can turn them into a competitive advantage. Climate change has influenced our strategy on highest possible level, described in our mission that is to convert renewable resources into sustainable results.

Read more about Valmet's sustainability risks and opportunities

Sustainability reporting

Valmet's sustainability reporting in is in accordance with the GRI Standards from the Global Reporting Initiative.

Valmet also reports to several third-party sustainability ratings to help its stakeholders assess our sustainability performance.

In 2023, Valmet was included in the Dow Jones Sustainability Index (DJSI) for the tenth consecutive year. The DJSI is a sustainability index family which includes the global sustainability leaders across industries. Valmet was listed both in the Dow Jones Sustainability World and Europe indices.

Valmet has been reporting to CDP's climate program ranking since 2015 and achieved the best A rating in 2023. CDP is an international, non-profit organization that collects and assesses climate change information from companies and cities to help investors better understand the economic risks and opportunities that climate change presents to their portfolio companies.

Read more about Valmet's sustainability reporting

Our policies and related processes

Valmet's values, Code of Conduct and related policies form the foundation for sustainable business operations. We strive for globally consistent and transparent management practices so that all our stakeholders can reliably assess the company's sustainable operations and development.

Valmet's policies supporting sustainable operations:

-

IPR Policy

-

HR Policy

-

Drugs and Alcohol Guidelines at Valmet

-

Global Travel Policy

Read more about Valmet's operating principles.

360o Sustainability Agenda

Valmet's sustainability Agenda, Sustainability360º, was renewed in February 2022. The new agenda includes environmental, social and governance (ESG) perspectives to sustainability and covers Valmet’s entire value chain including the supply chain, own operations and the use phase of Valmet´s technologies.

The renewed Sustainability360º Agenda is based on a comprehensive assessment and evaluation of the sustainability topics that are most material to Valmet’s business and stakeholders within the company’s value chain. All the main material topics have concrete targets and action plans integrated into the company’s annual planning process.

Read more about the Sustainability360º Agenda.

Valmet has on March 1, 2024, established a Green Finance Framework applicable for the issuance of green debt instruments to further integrate its ambitious sustainability targets into its financing.

The Green Finance Framework is designed to support financing or refinancing eligible assets and expenditures that promote two key environmental objectives: enabling transition to a circular economy and mitigating climate change.

In Valmet’s framework, eligible assets and expenditures are divided into two categories: Valmet’s services that enable extending the lifetime of Valmet’s products in customer use and Valmet’s solutions that enable significant greenhouse gas emission reductions, supporting customers in the green transition.

Valmet has established a green finance committee to ensure the green financing will be directed to activities that meet the eligibility criteria in the Green Finance Framework. Valmet will publish Green Finance Report including allocation of proceeds and impact reporting annually as long as there is Green Financing outstanding or until full allocation of proceeds.

Valmet’s Green Finance Framework has received an independent second party opinion from ISS ESG, confirming the alignment of the framework with the Green Loan Principles 2023 and the Green Bond Principles 2021.

Links:

Valmet’s Green Finance Framework

ISS ESG’s independent second party opinion

Press release on March 1, 2024: Valmet publishes Green Finance Framework

Read more:

In this tool you can find Valmet's data about different sustainability topics

For more information please see the GRI Supplement 2023.

Global megatrends like climate change, urbanization, and the growing middle class in the emerging markets, are Valmet's long-term growth drivers. Climate change and global warming are significant challenges that are driving companies to rapidly transform and reduce their carbon dioxide emissions. Valmet believes that technology plays a key role in mitigating climate change and global warming in the transition to a carbon neutral economy. That is why Valmet has created a comprehensive Climate Program – Forward to a carbon neutral future, which includes ambitious CO2 emission reduction targets and concrete actions for the whole value chain. The program is aligned with the Paris Agreement 1.5°C pathway and UN Sustainable Development goals, and it continues our comprehensive sustainability work.

Since 2020, Valmet has been developing its climate-related financial disclosures and implementing the Task Force on Climate-related Financial Disclosures (TCFD) reporting recommendations to increase reporting of climate-related financial information.

Valmet's climate-related disclosure is described around the four areas according to the TCFD recommendations:

Governance

Strategy

Risk management

Metrics & Targets

The Board of Directors is responsible for the administration and the proper organization of the operations of the Company. The Board also decides on significant matters related to strategy (including climate related issues), investments, organization and finances and ensures that the Company has established the corporate values applied to its operations.

The President and CEO guides and supervises the operations of Valmet and oversees the progress on targets set in Valmet’s Sustainability agenda and the related Climate program.

Valmet’s Sustainability360º Agenda has been approved by the Executive Team. The President and CEO oversees the progress of actions to reach Valmet’s targets set in the Agenda. Valmet’s Executive Team determines and monitors the Agenda and targets, as well as all related policies. Valmet’s sustainability performance is reviewed annually by the Executive Team. The progress of Valmet’s Sustainability360º Agenda is reported to the President and CEO quarterly and one to two times per year to the Board of Directors of Valmet.

Climate-related issues are assessed and monitored widely by the organization management. Valmet is organized around five business lines and five geographical areas in addition to four corporate level functions (Finance; Marketing, Communications, Sustainability and Corporate Relations; Operational Development, and Human Resources). Climate-related issues are discussed in Executive Team as part of Valmet’s strategy and thus all Valmet’s operations.

Valmet’s Executive Team assists the President and CEO in the preparation of matters, such as Valmet’s business plan, strategies, policies, and other operative matters of joint importance. The President and CEO acts as chairman of the Executive Team, where strategic level climate-related issues are managed.

Valmet’s Senior Vice President for Marketing, Communications, Sustainability and Corporate Relations is responsible for sustainability at Valmet. She is a member of Valmet’s Executive Team and the Chair of Valmet’s Climate Program Steering team, reporting to the President and CEO.

Valmet’s Climate Program Steering team is responsible for the Climate Program; follows the progress of the targets and provides status updates and guidance on governance and content quarterly. The Steering team includes two members of the Executive Team, the Vice President of Sustainability, the program part owners: Vice Presidents of HSE, R&D and Supply Chain, and other key persons. The progress of Valmet’s Climate Program is reviewed bi-annually by the Executive Team and annually by the Board of Directors.

Valmet’s Sustainability team is part of the Marketing, Communications, Sustainability and Corporate Relations function. The Sustainability team is responsible for coordinating and developing sustainability and related processes at the Valmet level and manages the groupwide Sustainability Agenda and the initiatives it contains. In addition, all Valmet’s corporate functions, business lines and areas are responsible for ensuring that all groupwide initiatives are implemented to meet Valmet’s sustainability goals.

Valmet has tied selected sustainability topics such as health and safety and sustainable supply chain KPIs to remuneration. The progress of actions related to Valmet’s Sustainability360º Agenda and its related Climate Program is used as a strategic target for Valmet’s Executive Team in the company’s long-term share-based incentive plan for the 2023–2025 performance period.

Sustainability is an integral part of our strategy and related Must-Wins that provide structure and focus for our strategic initiatives, decisions, and performance indicators. It is integrated in our processes through the comprehensive Sustainability Agenda and related Climate program. Our Sustainability360° agenda has nine focus areas with systematic target setting, annual action plans and monitoring of progress.

Valmet develops and supplies energy and environmentally efficient clean technologies that contribute to mitigating climate change. Climate change is also one of the main drivers affecting Valmet’s business and strategy. The strategic importance increased in 2021, when Valmet's Board approved Valmet’s Climate program, which includes long-term CO2 reduction targets for own operations, supply chain and our own technologies during use phase. Climate-related issues are relevant for the whole Board and discussed and monitored by the Board of Directors.

Climate change and transition into carbon neutral economy are among the driving forces behind Valmet´s strategy. Valmet is mitigating climate change, adapting to global warming, and driving the transition of the pulp and paper industry towards carbon neutrality by enabling energy and resource-efficient, carbon neutral pulp, paper, and energy production.

Valmet is the leading global developer and supplier of process technologies, automation and services for the pulp, paper, and energy industries. Valmet’s technologies and services enable customers to produce their products with less energy and water, and fewer emissions, chemicals and raw materials, and to further improve flexibility in fuel source selection to replace fossil fuels with renewable ones.

At Valmet, climate-related issues are integrated into key business processes including strategy, risk management, R&D, sales, project management, HR, procurement, and operational development. Climate-related issues are part of target setting, progress monitoring and reporting including financial KPI´s.

Valmet continuously enhances environmental efficiency throughout its value chain. Our process technology, automation and services are designed to improve raw material, energy, water and chemical efficiency and reduce waste from processes. As Valmet sees transition to carbon neutral economy as an opportunity, Valmet has identified the development and expansion of low carbon and environmental efficiency technologies and services as a possibility to increase revenue. Valmet’s systematic work on Research and Development gives a significant input to realizing this opportunity. Valmet’s updated R&D technology vision for 2030 highlights the importance is the key to change climate-related risks to opportunities. Our R&D plays a key role in Valmet’s Climate program ensuring we will meet our targets to improve energy efficiency and enable carbon neutral pulp and paper processes for our customers . Valmet focuses to develop environmental efficient, carbon neutral products and services in the long term to ensure our position as the preferred partner for customers. We aim to create growth by developing new technologies to replace fossil-based materials and energy with CO2 neutral options and to produce new high-value end products from fiber-based materials or waste streams.

In 2022, Valmet launched a new R&D and innovation program called Beyond Circularity, which improves Valmet’s readiness to support the green transition in Valmet’s customer industries based on the company’s technology vision 2030. The project aims to further strengthen Valmet’s R&D work in order to develop process technologies, automation and services for utilizing renewable materials and recycled waste and side streams. To support Valmet in achieving these ambitious project aims, Valmet will start building an ecosystem that aims to attract suppliers, universities, research institutes, startups, and customers to participate in making the green transition a reality within the pulp and paper industry. This ecosystem is expected to have more than 100 partners in 2025. Valmet plans to invest EUR 40 million in the project during the upcoming four-year period. The project is partly funded by Business Finland and is part of the ”Veturi” initiative.

Demand for carbon neutral technologies and services has impacted Valmet's strategy, products, services and offering. Valmet has a full scope CO2 emissions reduction and environmental efficiency offering that can reduce CO2 emissions while ensuring cost-efficiency. Valmet continues to invest in the development of new concepts and processes that reduces the environmental impact of the entire life cycle of its products. Read more on how we are minimizing CO2 emissions in board and paper and tissue production and how we can already today offer carbon-free pulp and energy production.

In addition, we see that circular economy is an integral part of mitigating climate change. The fundamental idea of a circular economy is embedded in our mission: Converting renewable resources into sustainable results. We are constantly improving our processes to increase resource efficiency and aim to maximize the use of recycled materials in our technology offering.

The successful management of climate-related risks and opportunities is a key element in the delivery of our strategy. Therefore Valmet has analyzed the potential impact of climate change on its operations and business environment by 2030 across the value chain, including the supply chain, own operations, and customers' use phase of Valmet's technologies. The potential long-term impacts of climate change have been analyzed through two different scenarios: in the first scenario the global warming is limited to 1.5°C and in the second scenario the global warming has reached 4°C. Read more about Valmet's climate scenario analysis. Below we have summarized the identified climate-related transition and physical risks and opportunities (see also Sustainability risks and opportunities).

CLIMATE-RELATED RISKS

|

Transitional risks |

Financial impact |

Time horizon |

Key mitigating actions |

|

Regulation Stricter climate-related regulation and initiatives may change the availability and use of biomass, and increase the cost of raw materials (such as steel) and energy, result in new taxes and tariffs, and change our stakeholder’s attitudes, which could impact Valmet’s and its customers’ operations and business environments. |

Medium - High |

Long |

Monitoring and participation to public discussion with facts, analysis and information on possibilities offered by different technologies. |

|

Technology If Valmet’s technologies are not considered to be sustainable, their demand will decrease, access to capital might deteriorate and the cost of capital might increase in the long term. Weakened capital environment can lead to decrease in R&D investments and our possibilities to offer our customers low carbon technologies. Inability to meet customer requirements threatens business continuity in the long term. |

Medium - High |

Long |

Monitoring and participation to public discussion with facts, analysis and information on possibilities offered by different technologies. Monitoring technology development to ensure correct timing of investments and divestments. |

|

If Valmet’s adaption to carbon neutral economy is low, there is a risk of losing competitiveness and consequently customers, revenue and profits. |

High |

Long |

Valmet’s updated Technology strategy and vision for 2030, incl. investments in developing new technologies to replace fossil materials and fossil energy with renewable ones and to produce new high-value end products from fiber-based materials or waste streams, is the key to change climate-related risks to opportunities. |

|

Market Changes in the business environment, e.g. regarding to the use of biomass, customers’ willingness to pay for climate resilient solutions and customers’ increasingly different expectations between regions, can pose risks to Valmet. |

Medium |

Long |

Close dialogue with customers. |

|

Reputation Poor climate related performance or negative perception by stakeholders may have adverse impact on Valmet´s overall brand image globally and also to net sales. |

Medium |

Long |

Compliance of our technologies and operations with regulatory requirements. |

| An increasing reputational risk to be associated with unsustainable use of forestry resources (deforestation, biodiversity loss) as society is increasingly protecting and extending forests to mitigate climate change. |

Medium |

Long |

Continuous dialogue with stakeholders, including NGOs. |

|

Physical risks |

Financial impact |

Time horizon |

Key mitigating actions |

|

Acute Climate change increases the amount and severity of weather extremes (i.e. floods, storms) globally that may impact Valmet's own production sites e.g. in India, China, and North America potentially by leading to production shutdowns and having a financial impact. |

Low |

Short |

|

|

Chronic Longer-term shifts in climate patterns causing sea level rise would pose a risk to Valmet's operations e.g. in China and Indonesia. Also access to raw materials in supply chain may be impacted by chronic changes in the environment. |

Intermediate |

Long |

|

CLIMATE-RELATED OPPORTUNITIES

|

Transitional opportunities |

Financial impact |

Time horizon |

|

Resource efficiency The demand for energy, raw material and water efficient solutions may grow in the near future. |

Medium- High

|

Short

|

| New regulations may increase demand for Valmet´s resource efficient solutions. |

High |

Medium - long |

|

Improving resource efficiency in our own operations may decrease operational costs. |

Low |

Short |

|

Products/ Valmet assesses that around 95% of the environmental impacts of Valmet’s entire value chain take place during customer use phase, and therefore by developing low carbon technology, Valmet can enable significant CO2 emission reduction for its customers through its technology. |

High |

Medium |

|

Valmet invests on research and development of new carbon neutral technologies, which can improve competitive position and capitalize on shifting consumer preferences. |

Medium |

Long |

|

Energy Source Valmet offers carbon neutral heat and power production with its biomass-based energy solutions which attractiveness highly increasing. |

Medium |

Short, medium, and Long |

|

Market Valmet is actively seeking opportunities to position itself in the carbon neutral market and to increase Valmet’s valuation in the long term. |

High |

Long |

| Valmet’s environmentally efficient solutions may increase company valuation and possibilities to reduce the cost of capital through better green finance terms. |

Medium |

Medium -long |

| Pulp, paper and bioenergy industries are considered to be carbon neutral, which may bring reputational opportunities to Valmet and lead to higher demand from customers, better talent attraction and retention rates. |

Low |

Short and medium |

|

Resilience Valmet is developing its resilience by improving environmental efficiency, designing new production processes, and developing new products. |

High |

Long |

|

Physical opportunities

|

Financial impact |

Time horizon |

| Increasing natural phenomena will create demand for Valmet’s repair services and solutions. |

Medium |

Long |

Risk management

Valmet has a continuous multi-disciplinary company-wide risk management process, where climate-related issues are integrated. Valmet has a systematic method to identify, assess and manage the probability and impact of climate related risks at all the stages of the value chain on a Group level and also within each reporting segments on a regular basis in short, medium and long term.

Climate-related risks related to direct operations, as well as the up/downstream are identified, assessed and responded with the same risk assessment process as other types of risks in the Group Valmet risk management. Risks management covers strategic, financial, operational and hazard risks, which includes climate-related physical and transition risks.

The assessed risks are based on the Valmet’s risk profile in which the company risks are listed on the headline level and covers all operations.

Valmet’s risk process promotes opportunities. Furthermore, it aspires to minimize the adverse impacts of strategic, financial, and operational risks and to remove or mitigate hazard risks. The line management of Valmet’s businesses is operatively accountable for managing risks as part of its daily activities. Climate change and environmental risks are assessed once a year on a Group-level by Valmet´s Risk Management function.

Valmet has defined targets and key performance indicators for climate-related risks and opportunities in line with its strategy and risk management process.

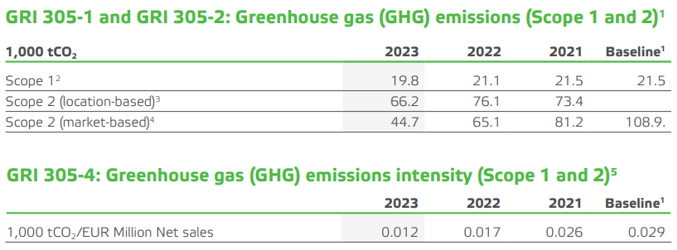

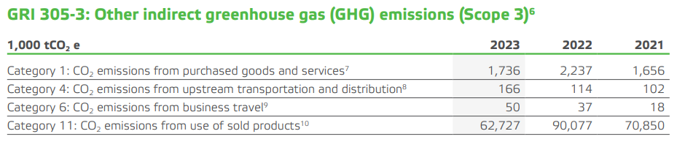

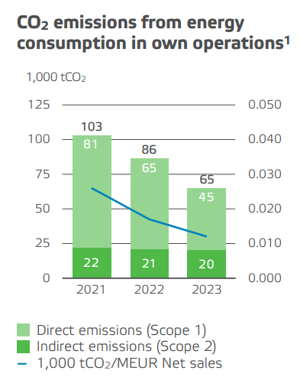

GHG emissions

Valmet’s has set ambitious CO2 reduction targets and concrete actions for 2030 for the entire value chain. The program targets were approved by the Science Based Targets initiative (SBTi). More about the climate targets and actions, see Valmet’s Climate program and Annual Review 2023 p. 47-49

Valmet’s greenhouse gas emissions are defined and reported according to the Greenhouse Gas (GHG) Protocol guidelines. For a more comprehensive summary of Valmet’s emissions and calculation methodology, see GRI Supplement 2023 p. 28.

Other environmental metrics

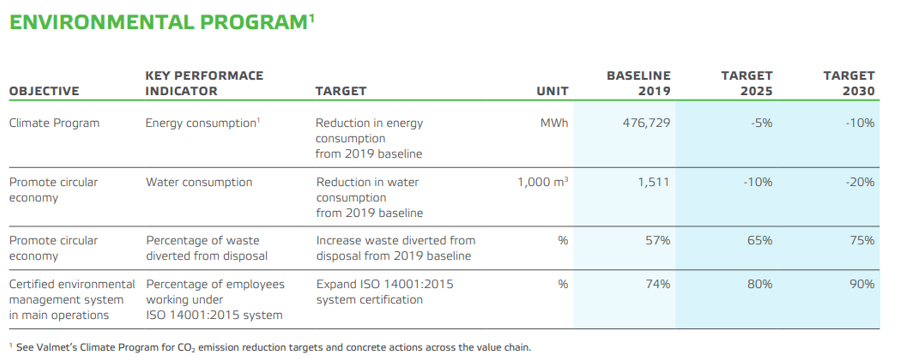

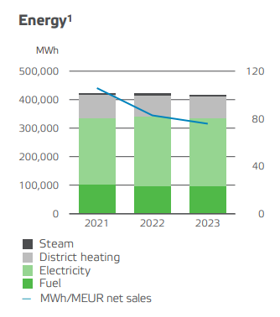

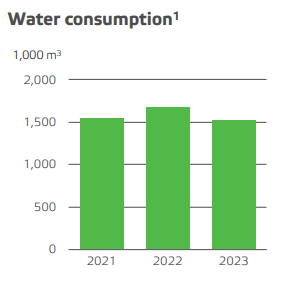

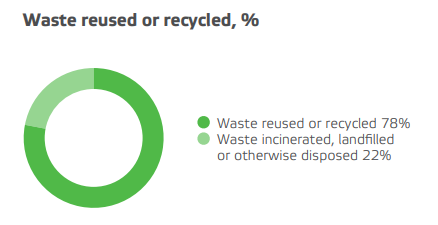

Valmet has also in place a dedicated Environmental Program, which sets targets for waste reduction and water consumption by 2025 and 2030.

To manage and improve environmental efficiency in our own operations, we have had an environmental program in place since 2009, with ambitious targets for reducing energy, water, and waste.

In 2022, we updated the targets and baselines of the program to 2030:

Valmet monitors energy, waste and water amounts:

More information, see Annual Review 2023 p. 51 and GRI supplement, p. 26-31.

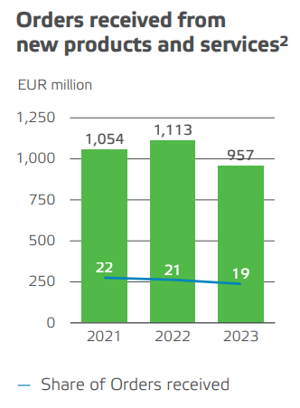

Orders Received of new products and services

Valmet’s new products and services reduce CO2 emissions, water and raw material consumption and waste, while increasing energy efficiency. Valmet monitors the market demand for more environmentally efficient technologies by monitoring the share of orders received from new products and services. More information see Non-financial information statement. p.16

Valmet has analyzed the potential impact of climate change on its operations and business environment by 2030 across the value chain, including the supply chain, own operations, and customers’ use phase of Valmet´s technologies. The potential long-term impacts of climate change have been analyzed through two different scenarios: in the first scenario the global warming is limited to 1.5°C and in the second scenario the global warming has reached 4°C.

These scenarios have been chosen as they represent different climate states of the future. The scenarios are also in line with the Task Force on Climate-related Financial Disclosures (TCFD) reporting, which recommends organizations to take into consideration different climate-related scenarios. The scenario analysis enables organizations to identify potential climate-related risks and opportunities and assess how prepared they are for different climate scenarios.

The scenarios are set for 2030, as it is far enough in the future to analyze the potential business impacts when climate-related risks have most likely materialized, and to analyze outcomes from company strategy and risk management perspective.

Valmet’s exposure to climate-related risks and opportunities have been analyzed under the following risk categories: Physical (such as storms, floods, and drought), regulatory, technological, market, reputation, and social. Exposure refers to an organization’s vulnerability to negative impacts or ability to realize positive impacts from the transition to a low-carbon economy and the impacts of climate change itself.

The results of the scenario analysis are utilized to support Valmet's strategy and capability to adapt to and mitigate climate change.

Summary of the results

In both scenarios, Valmet is seen to benefit from its energy and water efficient technologies and its position as one of the enablers of climate change mitigation. Demand for technologies enabling carbon neutral pulp, paper, and energy production together with alternative energy sources, such as biomass and CO2 free electricity, are likely to increase rapidly. There are also reputational opportunities to Valmet, if pulp and paper and bioenergy industries reach carbon neutrality enabled by Valmet’s technologies.

Differences between the two scenarios are expected to emerge more towards 2050 as negative climate events become more frequent and severe, especially in the 4°C scenario. In the 1.5°C scenario, transitional impacts, such as regulation play a bigger role, and in the 4°C scenario physical impacts dominate, such as floods, volatile forest yield, storms, and drought.

First scenario: The global warming is limited to 1.5°C

Valmet is committed to the Paris Climate Agreement´s 1.5-degree pathway. In this 1.5-degree scenario, where the global warming is limited to 1.5°C, the Paris Climate Agreement goals have been met and the mitigation of climate change has been strong.

In this scenario, it is expected that regulations will be more ambitious, globally consistent, and aiming for low-carbon economy. The demand for sustainable and climate resilient solutions creates opportunities for Valmet. The potential risks rise from the high demand for bio-based products, which increases competition for forest-based raw material. Availability of forest-based raw material for pulp and paper and energy industries might face limitations, impacting the growth potential for Valmet. There is also an increasing risk that forest utilization as raw material will be seen more negatively as protecting and extending forests to mitigate climate change is expected to increase. This increases reputational risks also for Valmet as a technology provider.

Second scenario: The global warming has reached 4°C

Second scenario reflects the situation where the global warming has reached 4°C, which means that emissions have continued to rise at current rates.

In this scenario, transition to low-carbon economy is disorganized, as climate policies are fragmented, carbon markets are not integrated, and carbon leakage will increase due to large differences in carbon regulations between countries. The demand for energy and water efficient technologies will grow in advanced economies, whereas in developing markets the demand is not likely to change.

Overall, Valmet’s offering in low-carbon and water efficient solutions will provide limited competitive advantage. There is also a risk that customers are not willing to pay for such solutions, and that the expectations of customers between regions will increasingly differ.

|

1.5°C scenario (RCP2.6) |

4°C scenario (RCP8.5) |

|

+ Valmet can benefit from its energy and water efficient technology as well as its position as one of the enablers of climate change mitigation. + If pulp and paper and bioenergy industries reach carbon neutrality enabled by Valmet’s technologies, it will bring reputational opportunities to Valmet. + Valmet’s sustainability reputation can lead to higher demand from customers, better talent attraction and retention rates. + New regulations are expected to increase demand for Valmet’s solutions. + Increasing natural phenomena are likely to create demand for Valmet’s repair services and solutions. + Valmet’s sustainable business can increase it possibilities to reduce the cost of capital through better green finance terms. ± Forest yield volatility and regional differences are likely to increase creating both risks and opportunities for Valmet. - Increasing drought increase forest-fire risk, and warmer winters are likely to increase the impact of pests and diseases on forestry yield. - Carbon pricing is expected to significantly increase the price of Valmet’s key raw materials, such as steel. - If cofiring of biomass is not considered to be sustainable, unless it’s coupled with carbon capture and storage, demand for these solutions will decrease. - If Valmet’s adaption is low, there is a risk of losing competitiveness and consequently customers, revenue and profits. - High demand for biobased products as well as the competition for biobased and forest-based raw materials may increase cost for customers. - An increasing risk that forest utilization as raw material will be seen more negatively, which increases reputational risks also for Valmet as a technology provider. |

+ Increasing natural phenomena are likely to create demand for Valmet’s repair services and solutions. + The demand for energy and water efficient solutions will grow in the near future, which brings benefits to Valmet as a technology provider. + Valmet’s low-carbon and water efficient solutions will provide limited competitive advantage. ± Forest yield volatility and regional differences are likely to increase creating both risks and opportunities for Valmet. - Increasing drought increase forest-fire risk, and warmer winters are likely to increase the impact of pests and diseases on forestry yield. - Customers may not be willing to pay for climate resilient solutions. - Expectations of customers between regions will increasingly differ. |

The scenario analysis has been done with IPCC’s RCP2.6 and RCP8.5 scenarios. Transition scenarios were considered for the whole value chain according to IEA (Sustainable Development Scenario and World Energy Outlook 2020) and IRENA (Global Renewables Outlook: Energy Transformation 2050) scenarios. IIASA's Shared Socioeconomic Pathways was used alongside the RCPs to analyze the feedbacks between climate change and socioeconomic factors, such as world population growth, economic development and technological progress.

Quantitative analysis of selected climate-related risks and opportunities

Based on the risks and opportunities identified in the qualitative climate scenario analysis, Valmet conducted a quantitative modelling of its most impactful climate-related risk and opportunities. Focusing on Valmet’s largest geographical locations and key elements in the supply chain, the analysis provided a financial impact range for the climate related risks and opportunities by 2030, based on the 1.5°C and 4°C scenarios.