Commodity risk management

Valmet is exposed to risk in variations of the prices of raw materials and of supplies including energy. Subsidiaries have identified their commodity price hedging needs and hedges have been executed through Treasury using approved counterparties and instruments. For commodity risks separate overall hedging limits are defined and approved. Hedging is done on a rolling basis with a declining hedging level over time. Electricity exposure in the Nordic subsidiaries has been hedged with electricity forwards and fixed price physical contracts. Hedging is focused on the estimated energy consumption for the next two-year period with some contracts extended to approximately five years. The execution of electricity hedging has been outsourced to an external broker. As at December 31, 2022, Valmet had outstanding electricity forwards amounting to 169 GWh (171 GWh) and 158 GWh (158 GWh) under fixed price purchase agreements.

To reduce its exposure to the volatility caused by the surcharge for certain metal alloys (Alloy Adjustment Factor) comprised in the price of stainless steel charged by its suppliers, Valmet may enter into average-price swap agreements for nickel. The Alloy Adjustment Factor is based on monthly average-prices of its components of which nickel is the most significant. Also, to reduce steel scrap price risk in Valmet’s own foundry operations, Valmet can hedge steel scrap prices using average price swap agreements. As at December 31, 2022, Valmet had 192 metric tons outstanding average-price swap agreements for nickel (42 metric tons) and 1,048 metric tons for steel scrap (0 metric tons).

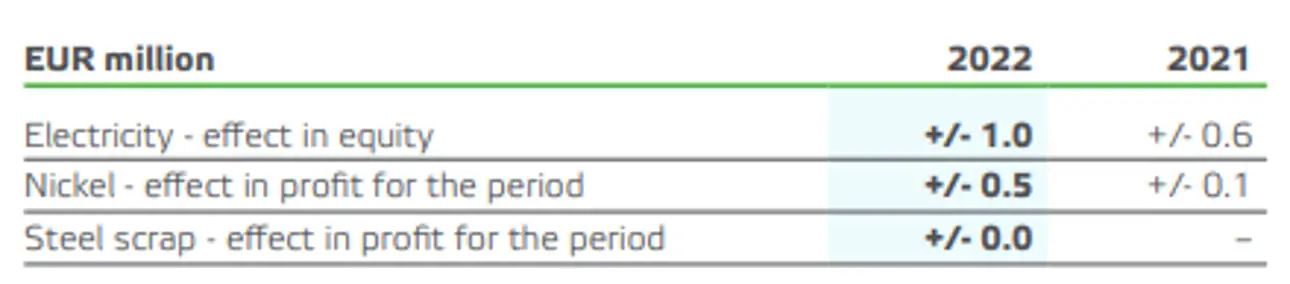

The following table presenting the sensitivity analysis of the commodity prices comprises the net aggregate amount of commodities bought through forward contracts and swaps but excludes the anticipated future consumption of raw materials and electricity.

A 10 percent change upwards or downwards in commodity prices would have the following effects, net of taxes:

Cash flow hedge accounting has been applied to electricity forward contracts and the change in fair value is recognized in equity. Hedge accounting is not applied to nickel and steel scrap agreements and the change in the fair value is recorded through Consolidated statement of income.