Capital structure management

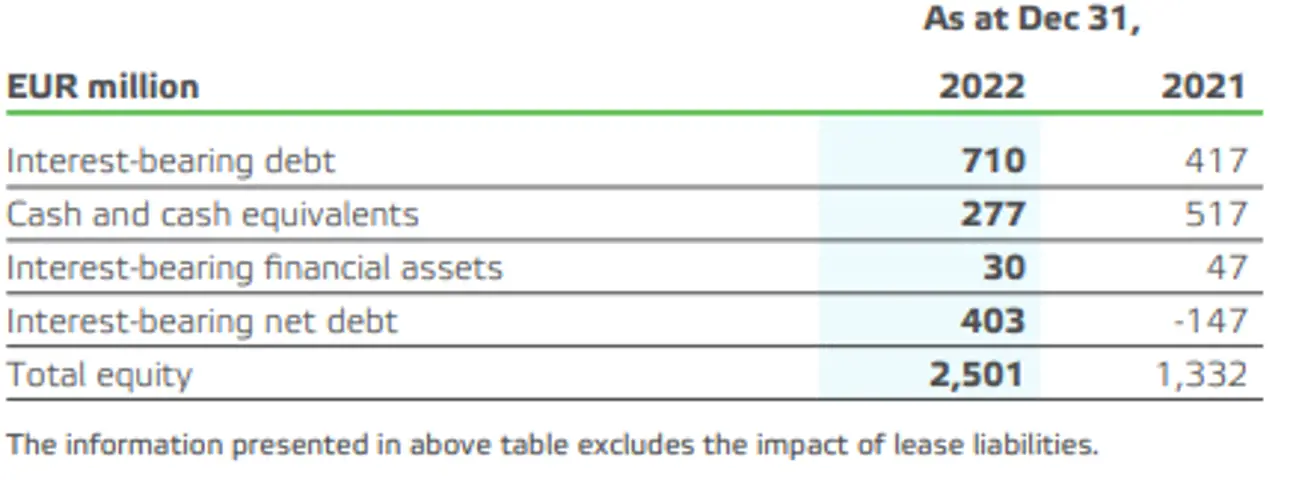

The capital structure management seeks to safeguard the ongoing business operations, to ensure flexible access to capital markets and to secure adequate funding at a competitive rate. Capital structure management at Valmet comprises both equity and interest-bearing debt. As at December 31, 2022, total equity was EUR 2,501 million (EUR 1,332 million) and the amount of interest-bearing debt was EUR 710 million (EUR 417 million).

Valmet has not disclosed any long-term financial ratio target for its capital structure. However, the objective of Valmet is to maintain strong capital structure in order to secure customers’, investors’, creditors’ and market confidence. The capital structure is assessed regularly by the Board of Directors and managed operationally by Treasury. Loan facility agreements include customary covenants and Valmet is in clear compliance with the covenants at the end of the reporting period. Valmet had no credit rating at December 31, 2022.

At the end of 2022, gearing was 20 percent (-7%) and equity to assets ratio was 49 percent (42%). Interest-bearing liabilities amounted to EUR 809 million (EUR 477 million), and net interest-bearing liabilities totaled EUR 502 million (EUR -88 million) at the end of the reporting period. Interest-bearing liabilities increased mainly due to consolidation of Neles.