Valmet is celebrating 10-year anniversary as a stock listed company

Jan 2, 2024

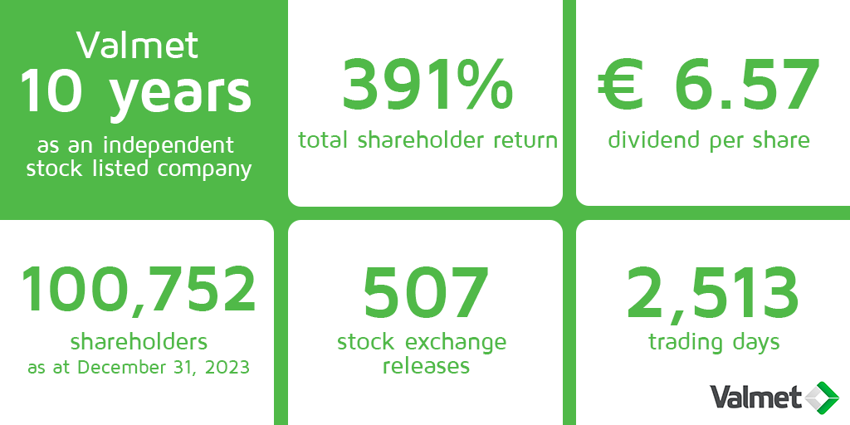

Tuesday, January 2, 2024, is not just a usual start of a year from Valmet Investor Relations’ perspective. It is an anniversary: today it has been exactly ten years since the trading with Valmet’s shares began on the official list of NASDAQ OMX Helsinki.

On October 1, 2013, Metso’s Extraordinary General Meeting decided to demerge Metso Corporation into two separate listed companies. After the demerger, the Mining and Construction and Automation business remained as part of Metso, and the Pulp, Paper and Power business formed a new company, Valmet Oyj. The trading of shares in Valmet on the official list of the Helsinki Stock Exchange commenced on January 2, 2014.

President and CEO Pasi Laine rings the bell to open trading at Nasdaq OMX Helsinki on January 2, 2014.

Valmet team at Times Square on May 21, 2014.

The 10-year journey as a stock listed company has been a memorable one so far, with some twists and turns on the way. To name a few, the acquisition of Process Automation Systems business and the merger with Neles have both been moments which have transformed the company.

The acquisition of Process Automation Systems from Metso was completed on April 1, 2015, forming Valmet’s fourth business line, Automation (today Automation Systems). The merger with Neles was completed on April 1, 2022, and marked the start of Valmet’s fifth business line, Flow Control. These business lines are now an integral part of Valmet as the Automation segment, which differentiates Valmet from competition.

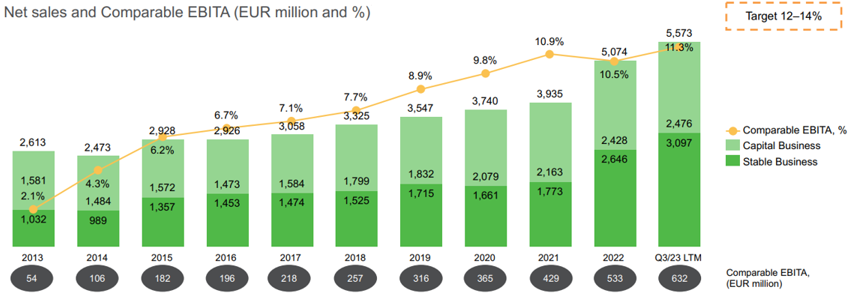

In terms of financial figures, Valmet also looks a lot different than it did ten years ago. In 2013, Valmet’s net sales were EUR 2,613 million and EBITA EUR 54 million. During the last four reported quarters (Q4/2022 – Q3/2023), Valmet’s net sales totaled EUR 5,573 million and Comparable EBITA amounted to EUR 632 million. Especially Valmet’s stable business, consisting of the Services and Automation segments, has grown well during the decade, going from EUR 1,055 million of orders received in 2014 to EUR 3,118 million during the last four quarters. Looking at the figures, it is fair to say that Valmet’s financial development during these past ten years has been excellent.

Net sales and Comparable EBITA development since 2013.

The good financial results combined with favorable megatrends supporting future demand for Valmet’s technology and services have also been reflected in share performance. The closing price for Valmet share on the first day of listing ten years ago was 6.65 euro. At the end of 2023, the share was valued at 26.11 euros. Had a shareholder bought Valmet shares on January 2, 2014, and sold them in the end of 2023, s/he would have got a return of 293% to the original investment. When we add the dividends Valmet has paid to shareholders during this decade, we get the total return of 391%. Now that is quite a figure!

Valmet share price development compared to market index.

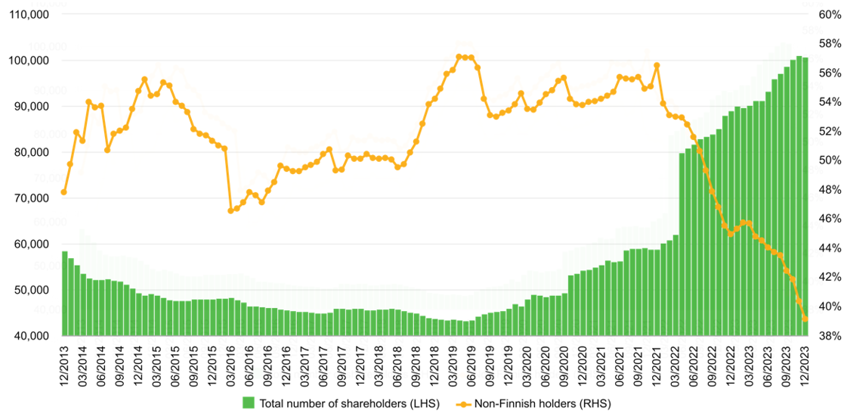

Valmet’s shareholder base has also seen big changes during the time when the shares have been traded in the stock market. After the demerger, Valmet had just under 60,000 shareholders. From there, the number of shareholders declined steadily, with the figure being under 45,000 in 2018 and 2019. However, after that, the increase in the number of shareholders has been rapid and in November 2023 Valmet reached the milestone of over 100,000 shareholders. There are only 12 other companies in Finland currently above the 100,000 line.

One explanation to the increased number of shareholders is that investing directly in shares has become more popular among Finns during the last decade. In Valmet Investor Relations we have also expanded our service for this target group by e.g. marketing Valmet as an investment in Instagram and publishing more blog posts and videos on our investor website.

The amount of Valmet’s non-Finnish ownership has been at around 50% level during the decade, but recently the amount has decreased to around 40%. This is the other side of the same coin, as private investors in Valmet are mostly Finnish. Furthermore, we have recently got a big Finnish institutional shareholder to Valmet, as Oras Invest has increased their holding to 9.05% and is now the second biggest owner after Solidium.

The development of Valmet’s ownership structure.

From the perspective of Valmet’s over 220 years of industrial history, ten years seems like a short time period. However, as you can see, many things have changed already during Valmet’s decade in the stock exchange. Let’s see what the next ten (or 220!) years have to offer.